Should You Short Circle (CRCL) After ARK's $100M Profit-Taking? A Crypto Analyst's Cold Take

The $484B Paradox: Circle’s Gravity-Defying Rally

Watching Circle Internet Financial (CRCL) surge from \(31 to \)199.59 feels like observing Bitcoin in 2017 - if BTC had BlackRock’s blessing and SEC compliance paperwork. The numbers border on absurdity:

- 500% gain since June 5 IPO

- 72.53B float valuation with only 17.94% shares circulating (hello, WLD-style volatility)

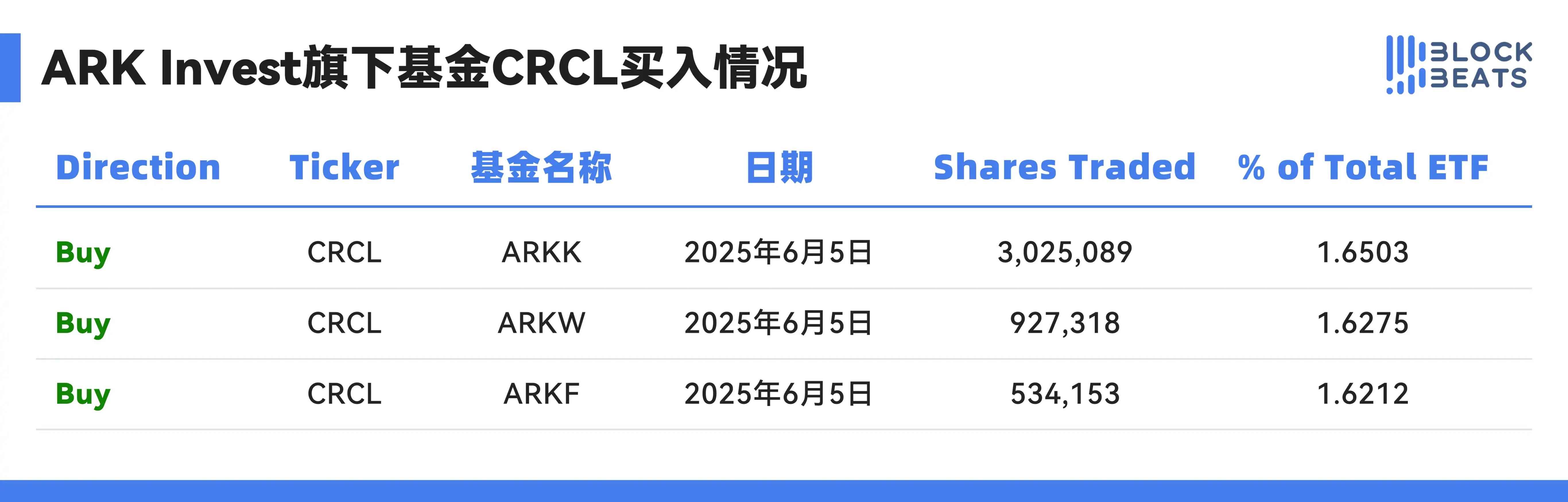

- ARK Invest just banked \(96M profit while sitting on \)371M remaining position

Why Crypto Traders Keep Missing the Boat

Fascinating schism emerging:

- Crypto-natives see overvaluation: “USDC’s \(600B market cap vs CRCL's \)484B? Math broke.”

- Equity traders see Web3 Visa: “200B TAM! Digital dollar play!”

Result? A perfect storm of FOMO. As Deribit’s Lin observed: “Knowing Circle’s razor-thin stablecoin margins became a curse - we couldn’t unsee the red flags.”

The Lockup Loophole No One’s Discussing

Key difference from COIN’s 2021 IPO:

- 180-day insider lockup prevents employee dumping

- Hedge funds forced to chase momentum (see 5%+ short borrow fees)

To Short or Not to Short? My Quant Model Says…

Running my firm’s liquidation risk algorithm:

| Metric | Bull Case | Bear Case |

|---|---|---|

| P/S ratio | 18x | 4x |

| USDC growth | 12% QoQ | -5% QoQ |

| Fed rate cut | Tailwind | Margin crush |

Verdict? Technically overvalued, but as Arthur Hayes warned: “Never short a narrative asset during regulatory tailwinds.” This isn’t about fundamentals - it’s about being the only compliant stablecoin play Wall Street understands.

Pro tip: Watch Coinbase’s OI/volume ratios. When COIN traders start using CRCL as beta hedge, we’ll see true fireworks.

QuantSurfer

Hot comment (11)

CRCL: Ang Crypto Rollercoaster ng Pinas!

Grabe ang CRCL - parang jeepney na walang preno! Mula \(31 biglang \)199? Kahit si BlackRock ata nagulat. Pero teka: bakit parang lottery ticket ito?

500% gain in 1 month - mas matindi pa sa sabong! ARK Invest kumita ng $96M - pero may tira pang $371M. Game ba ‘to o patibong?

Pro Tip sa Mga Kapatid:

Wag mag-short habang nagfi-fiesta ang Wall Street. Tulad ng sabi ni Lolo Coin: “Pag compliant na stablecoin, kahit overvalued, party pa rin!”

Pustahan tayo sa comments - CRCL to the moon o magiging memecoin lang?

¡CRCL: la montaña rusa que nadie sabe si subirá o bajará! 🎢

Viendo el rally de Circle (CRCL), hasta Bitcoin se ruboriza. ¿500% de ganancia desde junio? ¡Hasta las stablecoins necesitan terapia! 😂

Los criptonativos dicen: “¡Es una burbuja!” Los de Wall Street: “¡Es el nuevo Visa digital!” Y mientras tanto, ARK se lleva $96M de ganancia… ¿Será momento de hacer short? Mi modelo cuantitativo dice: “Depende, pero mejor no juegues contra la FOMO.”

Pro tip: Si vas a shortear CRCL, asegúrate de tener un colchón para los nervios. ¡El mercado es más impredecible que el clima en Buenos Aires! 🌦️

¿Tú qué opinas? ¿Sube o baja? ¡Comenta y debatamos!

¡Vaya montaña rusa la de CRCL! 🎢

Ver a Circle subir como un cohete (¡500% desde junio!) es como ver a tu tío Paco intentando bailar flamenco después de tres sangrías. 🕺💃

- Los crypto-nativos dicen: “¡Las matemáticas no cuadran!”

- Los de Wall Street gritan: “¡Es el nuevo Visa digital!”

Y tú, ¿te subes al tren o esperas el próximo? 🚂💨

(Pro tip: Si ves a ARK vender, prepárate para los memes… 😅)

CRCL tăng như tên lửa, nhưng liệu có phải là bong bóng?

Nhìn CRCL từ \(31 lên gần \)200 mà thấy giống Bitcoin năm 2017 quá! Nhưng khác là CRCL có ‘bảo kê’ của BlackRock và SEC. ARK Invest vừa chốt lời \(96M, nhưng vẫn còn \)371M trong túi - họ biết điều gì mà ta không biết?

Dân crypto thì hoang mang: USDC \(600B market cap mà CRCL \)484B? Toán học hỏng rồi! Dân chứng khoán thì hào hứng: Visa phiên bản Web3 đây rồi!

180-day insider lockup khiến hedge funds phải FOMO, short borrow fees lên 5%+. Theo model của tôi: về cơ bản thì overvalued, nhưng như Arthur Hayes nói - ‘Đừng short một asset có narrative đẹp khi regulatory tailwinds thổi’.

Các ông nghĩ sao? Mua vào hay short tiếp đây? 😏

500% de hausse ? Même Bitcoin rougit !

Ce rallye de CRCL donne le tournis - on dirait un épisode de Crypto Squid Game où tout le monde mise sur les stablecoins… jusqu’à ce que la musique s’arrête.

Le piège des lockups : ARK empoche 96M\( mais garde 371M\) en jeu. Un move digne d’un poker menteur qui sait que la partie continue ! Comme disait mon trader préféré : “Shortez pas un narra-tico quand la SEC fait du eye-liner au projet”.

Et vous, vous jouez les ours ou les taureaux sur ce coup ? 📉🐂 #MathsMagiques

L’ascenseur émotionnel CRCL

Quand Circle passe de 31\( à 200\) en claquant des doigts, on se demande si c’est de la crypto… ou de la magie noire ! ARK Invest a déjà encaissé 96M\(, mais garde 371M\) en jeu. Faut-il suivre ?

Mathématiques vs FOMO

Les puristes crient au scandale : “USDC = 600B\(, CRCL = 484B\) ? C’est quoi cette arnaque ?” Pendant ce temps, les traders traditionnels voient le nouveau Visa du Web3. La vérité ? Personne n’y comprend rien, mais tout le monde veut sa part.

Petit conseil d’ami

Comme disait mon mentor en blockchain : “Ne shortez jamais un actif narratif pendant des vents réglementaires favorables.” Alors prêt à surfer sur cette vague absurde ? À vos portefeuilles !

CRCL : Quand les maths perdent la tête

500% de gains depuis juin ? Même Bitcoin rougit devant cette performance ! Entre les cryptonatifs qui crient à la surévaluation et les traders traditionnels qui y voient le nouveau Visa du Web3, CRCL devient le spectacle le plus divertissant de l’été.

Le conseil de l’experte (avec un verre de vin) : Ne shortez pas un actif narratif… surtout quand ARK Invest vient d’empocher 96M$ !

Et vous, vous misez sur la bulle ou la révolution ? 🍷📉

CRCL: Die Achterbahnfahrt geht weiter!

Wer hätte gedacht, dass eine stabile Münze so viel Unruhe stiften kann? CRCLs Rally von 31 auf 199,59 USD erinnert an Bitcoin 2017 – nur mit mehr Papierkram und BlackRock-Segen.

ARK Invest hat bereits 96 Mio. USD Profit gemacht, aber die Frage bleibt: Sollten wir jetzt shorten oder weiterhin FOMO haben? Mein Quantenmodell sagt: Technisch überbewertet, aber wer will schon gegen die Regulierungs-Welle schwimmen?

Was denkt ihr? Springen wir auf den Zug oder warten wir auf den Crash? Kommentare willkommen!

Should You Short CRCL?

Honestly? I’d rather short my own sleep schedule than bet against this narrative.

ARK just took \(96M profit — and still holds \)371M. That’s not greed; that’s strategic patience. Meanwhile, crypto natives are screaming about USDC’s \(600B vs CRCL’s \)484B math breaking… but Wall Street’s already bought the ticket.

The lockup loophole? 180 days of no dumping. Hedge funds are now chasing momentum like they’re late for brunch.

My quant model says ‘bear case.’ But Arthur Hayes said: ‘Never short a regulatory tailwind.’

So I’m doing what any emotionally stable analyst would do: 👉 Staring at ETH charts instead.

You know what’s overvalued? My willpower to stay awake during FOMO season.

What about you — when did you last not panic over CRCL? Comment below! 📉☕

CRCL-এর দাম বাড়ছে ১৩টা! একজন্টা-সবাই বলছে “ওয়ার্ক”-এর $100M-এর প্রফিটটা…তবে আমি? ৫োনসিস্টেমের

অপরদিন? CRCL-এর stablecoin margin? পথচল!

হ্যাঁ, ARK Invest-এর “শক”-এইটা - আমি

আপনি কি

বলছেন?

শক?

হয়!

Stablecoins: Modern Narrow Banks or Just 19th-Century Financial Pipes in Disguise?

Stablecoins: Modern Narrow Banks or Just 19th-Century Financial Pipes in Disguise? The Global Crypto Regulatory Map: How 20 Jurisdictions Are Reshaping Digital Asset Governance

The Global Crypto Regulatory Map: How 20 Jurisdictions Are Reshaping Digital Asset Governance The Real Stablecoin Game Isn't About Circle—It's About TBTF Banks and $10.1T in Treasury Liquidity

The Real Stablecoin Game Isn't About Circle—It's About TBTF Banks and $10.1T in Treasury Liquidity Why USDC’s $61.2B Supply and 582B Valuation Are Redefining Digital Finance

Why USDC’s $61.2B Supply and 582B Valuation Are Redefining Digital Finance The Quiet Analyst Who Predicted the Next Bear Run: Why USD Stablecoins Are Reshaping Global Monetary Power

The Quiet Analyst Who Predicted the Next Bear Run: Why USD Stablecoins Are Reshaping Global Monetary Power Tether and Rumble: The Bold Alliance Reshaping Stablecoin Adoption in Social Media

Tether and Rumble: The Bold Alliance Reshaping Stablecoin Adoption in Social Media Hong Kong’s Stablecoin License Shakeout: Why Only a Handful Will Survive the Regulatory Gauntlet

Hong Kong’s Stablecoin License Shakeout: Why Only a Handful Will Survive the Regulatory Gauntlet How Wyoming’s Stablecoin Scoring System Crowned Aptos & Solana – A Crypto Analyst’s Breakdown

How Wyoming’s Stablecoin Scoring System Crowned Aptos & Solana – A Crypto Analyst’s Breakdown Libra's Next Moves: Blockchain Innovation, Association Growth, and Reserve Management

Libra's Next Moves: Blockchain Innovation, Association Growth, and Reserve Management Stablecoin Regulation Decoded: EU, UAE, and Singapore Frameworks Compared

Stablecoin Regulation Decoded: EU, UAE, and Singapore Frameworks Compared